Topics

Canarahsbclife | Canara HSBC OBC Life Insurance Plan and Policies

Canara HSBC OBC Life Insurance | Canarahsbclife (Asia Pacific) Holding Ltd, and Oriental Bank of Commerce have joined forces to form the company (OBC). Canara Bank has 51 percent of the stock in this business, while HSBC Insurance Canarahsbclife and OBC each own 26 percent and 23 percent, respectively.

The Company, which was founded on June 16, 2008, has unique access to around 60 million guests and a pan-India network of approximately 7000 branches of the three shareholder banks.

Canarahsbclife In addition, the organisation has 28 centres across the country to provide vital training and guidance to bank employees. Canara HSBC Oriental Bank of Commerce Life Insurance (Canarahsbclife) is the first to offer’Immediate Payouts on Death Claim,’ under which the departed’s family will get the fund value immediately upon enrolling in unit-linked programmes.

Canarahsbclife The Economic Times has given the company a “ET’s 2015 Promising Brands.” This accolade acknowledges the organisation as a reliable brand and demonstrates its dedication to customer service. Aside from that, the company received a number of notable accolades, including “Stylish Training Initiative for Insurance Sector,” “Life Insurance Company of the Year 2013,” and “Stylish Deals Development Programme.” “across Asia with vigilance

Canara HSBC OBC Life Insurance Plans (Canarahsbclife)

Canara HSBC OBC Life Insurance provides complete coverage for you and your family in the event of an unexpected occurrence. The insurer’s colourful plans guarantee maximum financial security in the event of your untimely death. This way, the plans can cover your child’s future and provide a nest egg to protect your older years. The insurer’s colourful policies are listed here.

Canara HSBC OBC Life Insurance – Latest Events (Canarahsbclife)

Canara HSBC OBC Life Insurance has organised the Earth Hour – Cyclothon with WWF-India for the eighth time in a row. The event will take place on March 19, 2016.

The company has scheduled a Cyclothon with a distance of 21 kilometres and a walkathon with a distance of 7 kilometres. Both the event conditioning and the event will take place at the same time. The event is scheduled to begin at 700 a.m. local time.

The event will take place at WWF-India, 172-B, Lodhi Estate, New Delhi, on Saturday, March 19, 2016, at 700 a.m.

- Asset Shrinkage at Canara HSBC OBC Life Insurance Company Canarahsbclife

- According to a Canara HSBC OBC Life Insurance survey, Indians prefer traditional life insurance to ULIPs Canarahsbclife.

- According to a Canara HSBC OBC Life Insurance survey, Indians prefer traditional life insurance to ULIPs Canarahsbclife.

- Canara HSBC OBC Life expects a 35% increase in new business in the current fiscal year. Canarahsbclife

Canara HSBC OBC Life Insurance Term Plans: Canarahsbclife

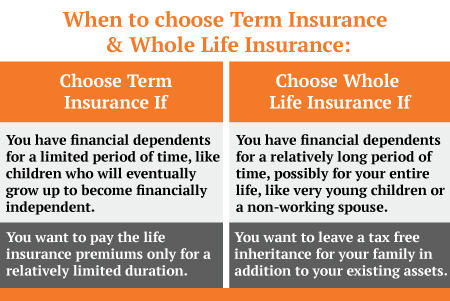

The cheapest and most important type of life insurance is one that guards against financial worries for your family and aids in securing their future after you pass away.

| Plan Name | Entry Age | Maturity Age | Policy Term | Sum Assured |

| iSelect Star Term Plan | 18-65 years | 28-80 years | 5-62 years (subject to the plan option chosen) | Rs. 25,00,000 & above |

| investshield Plan | 18-50 years | 28-65 years | 10-15 years (subject to premium payment term) | Single: 10-times the single premium Regular/Limited: 10 times of Annualized Premium |

1. iSelect Star Term Plan Canarahsbclife

The online-only iSelect Term Plan provides the best protection, offering features like Life Cover, Terminal Illness Cover, and content against death/disability. Additionally, it guarantees that your family receives regular cash in the event of an unforeseen circumstance. You can receive duty benefits for the decoration you paid into the plan in accordance with the living income duty laws.

2. Investshiend Plan Canarahsbclife

This unit- linked investment-cum-insurance plan is an ideal way to produce wealth to fulfill your future pretensions such a buying an asset or icing a bright future for your kiddies. This plan also offers a death benefit to the devisee in case of the demise of the ensured. Maturity benefit is offered. You can take the fund value in inaugurations as well. Fidelity additions are paid in the form of redundant allocation of units to the unit- linked fund. Also, partial recessions are allowed from the 6th policy time.

Canara HSBC OBC Life Insurance ULIP Plans: Canarahsbclife

These unit-linked insurance policies can assist you in saving money for your individual goals. These plans provide you the opportunity to pay for decorations for a shorter period of time, choose your life insurance provider, and invest your plutocrat in unit-linked investments of your choosing to meet your long-term financial aspirations.

1. Jeevan Nivesh Plan Canarahsbclife

You and your family are provided with lifetime protection with this saving-cum-protection plan. It guarantees assured savings via guaranteed payout of Sum Assured when the insurance matures. Endowment with Whole Life Cover is an option that provides a death benefit and the inflexibility to convert the guaranteed sum assured into a recurring income for the next 15 times at a compound interest rate of 5%.

2. Money Back Advantage Plan Canarahsbclife

Plutocrat Back Advantage Plan offers death content and corner-ground rewards via the guaranteed plutocrat back option to safeguard your family’s financial destiny. It also provides maturity benefits if you live to the end of the plan. If an unexpected occurrence occurs, the death benefit option payout may be paid up to 16 times. You will be given access to a guaranteed lump amount when the policy matures, which is equal to 55 percent of the sum assured plus the accrued benefit. You can get a discount on decorations for a significant amount guaranteed.

3. Smart Junior Plan: Canarahsbclife

You can ensure your child has a bright future with the aid of this plan. A lot of financial planning is required in light of the escalating affectation so that their aspirations can come true in your absence. This plan includes life lessons, and the quantum can be used to cover the child’s tuition costs. Additionally, the availability of numerous insurance terms lets you select a term that works best for you. With a large sum guaranteed, you can get a discount on furnishing.

4. POS-Easy Bima Plan : Canarahsbclife

a double life content benefit traditional insurance policy that is reasonably priced. The paid adornment is repaid when the policy reaches maturity. Additionally, it provides multiple decorating payment alternatives, allowing you to choose one that meets your needs. You can also receive mileage duty benefits under Sections 80C and 10 (10D) in accordance with the applicable duty legislation.

5. Smart Suraksha Plan Canarahsbclife

This plan provides life insurance and an accidental death/disability payout, securing your financial future and that of your family. This package offers a discount on the decoration for women and is reasonably priced. However, because it is term insurance, there are no maturity benefits provided.

6. Smart Future Income Plan: Canarahsbclife

With this strategy, you can multiply your income by 100. This plan gives a guaranteed yearly income for 15 years, a lump amount as a benefit, life insurance for 25 years, and the ability to borrow money against the planet. Depending on the insurer, you may receive an additional periodic benefit as a maturity benefit. Under this policy, a recurring benefit is also profitable.

7. Canarahsbclife’s Smart Monthly Income Plan

This Canara HSBC OBC life insurance plan includes periodic benefits, duty benefit, and a rebate of decoration in the event that the sum assured is equal to or greater than Rs., as well as a guaranteed yearly income for the last 15 years of the policy. Along with the last perk, a new periodic perk is granted upon maturity.

8. Samridh Bhavishya Canarahsbclife

This plan provides a guaranteed income for the foreseeable future. Your bank account is immediately credited with this recurring payment. A policy term of 5/10/15/ 20 times is an option. In the event of the untimely death of the first annuitant, the joint and life survivor subvention option provides 100 subvention benefit to the alternate annuitant. By raising the subvention rates, it also provides a substantial purchase price benefit. Additionally, you can receive mileage reimbursement for any paid decorations.

9. Canarahsbclife’s Smart Immediate Income Plan

If you are planning your withdrawal, you can still proceed with this strategy. In the event of the assured’s passing, it provides a continuation subsidy benefit with a 100% refund of decoration. If the primary annuitant passes away, the common-life and last survivor benefits provide the alternate annuitant with a 100 subvention. Additionally, it provides multiple alternatives for investing in subsidies, including yearly, daily, partial-monthly, and yearly.

Child Plans from Canara HSBC OBC Life Insurance: Canarahsbclife

The Canara HSBC plan offers you the chance to invest for the long term in order to provide a bright future for your kid as well as complete child insurance protection in the event of an emergency.

Unborn Smart Plan Canarahsbclife

This plan offers a long-term opportunity to safeguard your child’s future. It includes a thorough cover to protect your child’s future in the event of an unforeseen circumstance. In case of an emergency, partial pullout up to Rs. You can also change to a liquid fund with no risk. With this plan’s Auto Fund Rebalancing, you may keep your assets in line with your preferences.

Plans offered by Canara HSBC OBC and Traditional Investment: Canarahsbclife

Low-risk investment plans with guaranteed returns are offered by Canara HSBC OBC Investment & Traditional Plans.

Plan Titanium Plus Canarahsbclife

It is a unit-linked protection plan that provides unsurpassed rigidity and total investment control. For the selected policy period, it provides flexible decoration payment modes with death content. You can optimise the so-earned returns with the help of the various portfolio operating options. By providing new units, it also provides fidelity upgrades and a wealth supporter installation. It is difficult to switch between the available fund possibilities in accordance with your needs. The partial pullout option enables you to avoid unanticipated financial repercussions.

Canarahsbclife’s Smart Future Plan

This unit-linked plan offers long-term investing possibilities to meet your diverse family’s demands, such as purchasing an asset or securing your child’s future. It allows long-term capital growth as well as moving between funds up to a certain amount in Rs. In the event of a crisis, partial withdrawal is permitted from the sixth policy time. You can protect your cash and prevent request movement by using the safety switch option.

Plan for Smart Goals Canarahsbclife

This unit-linked insurance plan offers partial pullout benefits, life content, long-term capital appreciation, and more to assist you in arranging your financial situation. You can select from a variety of vibrant, pricey payment options, depending on your preferences. Additionally, you can modify your sum assured in accordance with changes in your life. You might select a safety switch option to eliminate any threat as soon as the policy is going to emerge.

Canarahsbclife’s Smart Lifelong Plan

This Canara HSBC OBC life insurance policy includes lifetime benefits up to age 99. You can choose and pay for the decorating in accordance with your capabilities and circumstances thanks to the flexible payment terms for decorations. Other advantages include a rise or fall in the amount promised, a partial withdrawal of the cash, a change in the rerouting of the finances, etc. You will be given the fund value when the policy matures.

Canarahsbclife’s Secure Bhavishya Plan

A guaranteed maturity benefit of 101 percent of the amount paid is provided by the plan. Based on your withdrawal needs, you may also decide on an unlimited top-up option. Additionally, you can select the maximum maturity age and decoration payment options as needed. Starting with the 10th policy term, a fidelity enhancement benefit is provided every five times to increase the fund value.

One Smart Pay Canarahsbclife

The has numerous advantages, including fund switching, partial withdrawal, fidelity adds, safety switch option, and fund rebalancing for bus funds, among others. This design just adds decoration, but it also gives you living content. Unlimited switching instals between funds are available to you.

Make a Smart Plan. Canarahsbclife

This plan allows for the creation of capital appreciation with its 6 possible fund selections. If you pay for the decoration via ECS or standing orders, you may mileage of a discount. Additionally, a partial pullout is permitted up toRs. Additionally, you have the option of moving some of your investments between funds. The sum assured may be increased or decreased starting with the sixth policy period, based on your insurance requirements.

You can increase your capital by investing in Small-Cap, Mid-Cap, and Large-Cap companies with this unit-linked insurance plan. This plan provides the restriction of paying the decoration only initially. Some of your investments can be freely switched from one fund to another on several occasions. Other advantages include partial withdrawal of funds, rebalancing of the bus fund, increasing or decreasing the sum assured, etc.

Plan Grow Smart Canarahsbclife

Your withdrawal days are guaranteed by this plan. It provides lifelong insurance coverage. It is simple to carry on because of the accommodating decoration payment term. You can take advantage of the freedom to select your life insurance according to your needs. After five times, you can if necessary withdraw a portion of your investment. Additionally, you can laboriously manage your hard-earned wealth by transferring it across other funds.

About it

Trade Logo of Canara HSBC Life Insurance Company Limited (formerly known as Canara HSBC Oriental Bank of Commerce Life Insurance Company Ltd) hereinafter referred to as “Insurer” is used under license with Canara Bank and HSBC Group Management Services Limited.

The Insurance products are offered and underwritten by Insurer (IRDAI Regn. No. 136) having its head office at, 139 P, Sector – 44, Gurugram – 122003, Haryana, India.

For more details on risk factors, terms and conditions please read the Sales Brochure carefully before concluding a sale.

Corporate Identity No.-U66010DL2007PLC248825 Website: www.canarahsbclife.com

Call (Toll free no.): 1800-103-0003/1800-180-0003/1800-891-0003

SMS: 9779030003

Missed Call: 0124-6156600

Email: customerservice@canarahsbclife.in

You may like:

Top 10 Best places to visit near Udaipur (Hill station, Waterfall, Temple)

2 thoughts on “Canara HSBC OBC Life Insurance canarahsbclife Term Plan”